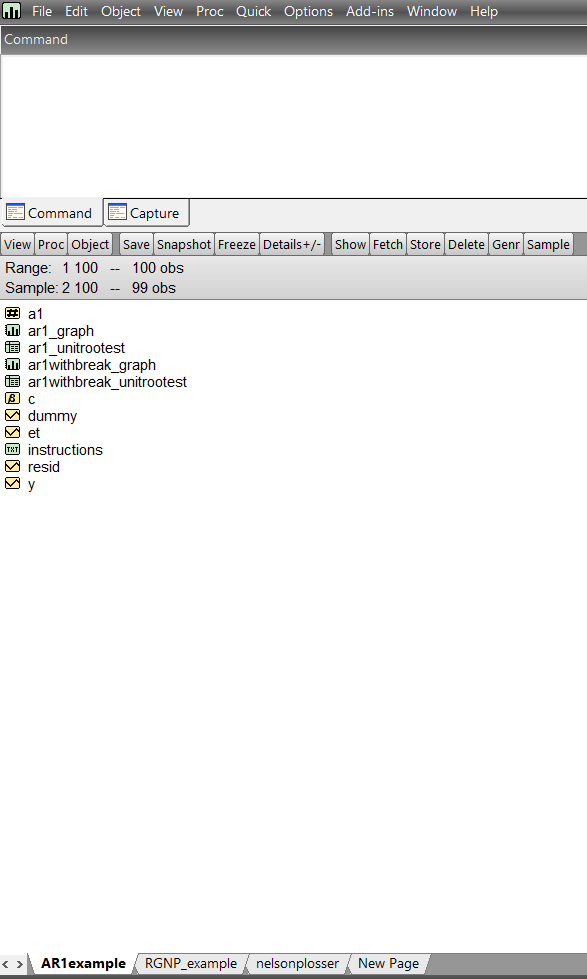

Uncover the secrets of time series analysis and forecasting with JDEConomics. Our package is designed to help you replicate and understand the groundbreaking research in Jean Perron's 1997 paper, "Further Evidence on Breaking Trend Functions in Macroeconomic Variables."

Jean Perron's 1997 paper, "Further Evidence on Breaking Trend Functions in Macroeconomic Variables," challenged the influential findings of Charles Nelson and Charles Plosser in their 1982 paper. Nelson and Plosser argued that macroeconomic time series, like GDP and consumption, followed non-stationary random walks with a unit root.

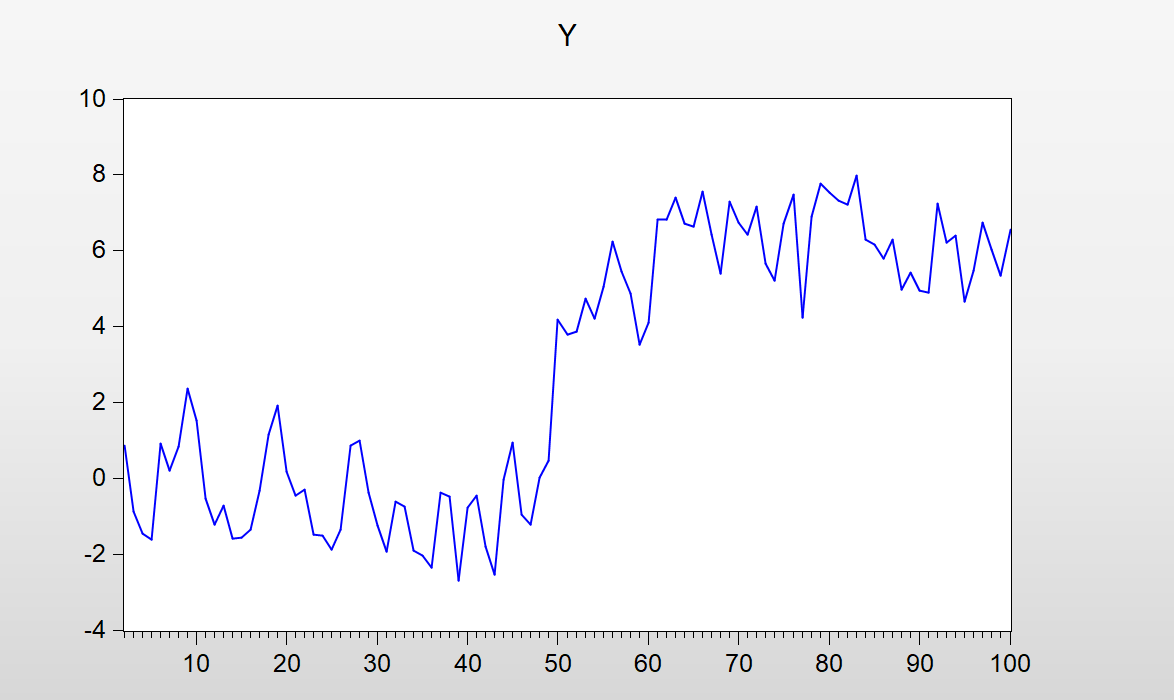

Perron sought to reassess this conclusion by examining the presence of structural breaks in macroeconomic variables' trend functions. He emphasized that ignoring structural breaks could lead to misleading interpretations of unit roots.

To address this, Perron introduced the Perron test, a modified version of the Dickey-Fuller test. The Perron test accommodates structural breaks within the unit root testing framework, enabling the identification of the number and timing of such breaks and providing more accurate estimates of the underlying trend.

By employing the Perron test, Perron reanalyzed several macroeconomic time series and detected evidence of structural breaks in their trend functions. Accounting for these breaks led to different conclusions regarding the variables' stationarity. Perron's findings suggested that many series previously deemed non-stationary by Nelson and Plosser might actually exhibit stationarity when structural breaks were accounted for.